Revolving Loan Fund

DOWNLOAD APPLICATION HERE

**Personal Financial Statement Template for RLF application

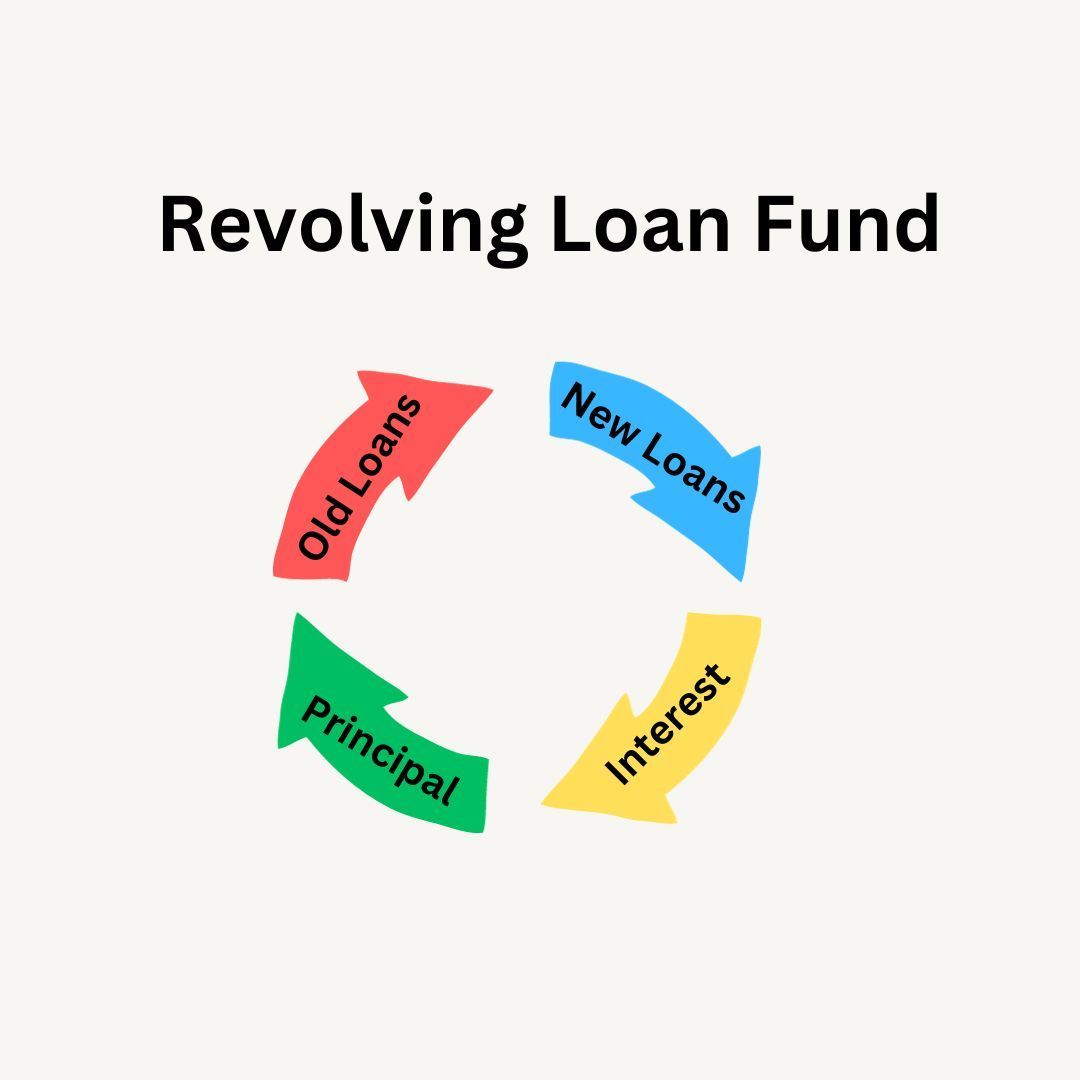

The Economic Development Council Revolving Loan Fund was established in 1996 through a grant from the State of Oregon Rural Development program. Overtime, the program was expanded to include funding from the USDA for the purpose relending to microenterprises. These programs offer funding for companies that do not qualify for conventional loans but create jobs and enhance business growth for the Tillamook County economy. The Revolving Loan fund supports the effort to maintain the quality of life by diversifying the county’s economic base.

Loans are available ranging from $5,000 to $30,000 (max $20,000 for start-ups). Loans must have a reasonable prospect of repayment and borrowers must provide collateral, although not necessarily real property collateral. The maximum loan cannot exceed 10 years and most often are issued for five year terms.

The applicant must prepare a business plan including balance statement, income statement, projected monthly cash flow for one year, and resumes for all owners and key personnel of the business. The Small Business Development Center offers FREE business advising and is available to assist in the application process. The EDC encourages applicants to take advantages of the resources offered through SBDC. As a requirement of the application, the business plan MUST be reviewed and signed off by an authorized person from the SBDC whether or not the applicant chooses to utilize other SBDC resources.

SIGN UP FOR FREE - SBDC BUSINESS ADVISING HERE

HOW LOAN FUNDS MAY BE USED

Funds are focused on creating family-wage jobs and facilitating business growth. Examples of possible uses of loan funds include but are not limited to:

- Starting a business

- Modernizing a plant or facility (RLF only)

- Operating capital

- Retraining a workforce

- Furniture, fixtures, supplies, inventory, equipment

- Business acquisition

- Debt refinancing (USDA program only)

- Purchase of already improved real estate (USDA program only)

INELIGIBLE LOAN PURPOSES

- NOT subsidizing interest payments on an existing loan

- NOT any project in violation of either a Federal, State, or local environmental protection law, regulation, or enforceable land use restrictions

- NOT any project excluded by applicable federal agency such as the SBA which includes gambling, cannabis-related businesses, pawn shops, and religious-based organizations

- NOT golf courses, races tracks, or gaming facilities

- NOT lines of credit

- NOT subordinated liens

APPLICANT ELIGIBILITY

Applicant must be for-profit business and must be a United States citizen or demonstrate legal status in the United States. Any entity that applies must have operations in Tillamook County to benefit the local economy. Applicants must show the inability to receive conventional financing. Applicants must have a registered LLC or corporation with the State of Oregon. If operating as a sole proprietor, applicant will be required to have dba on file.

For information on the EDC Revolving Loan Fund and whether your project could qualify, please contact Terre Cooper @ 503-842-8222 x2500 or Email: terrecooper@tillamookbaycc.edu

Other Financing Resource Links

Loans

http://www.oregon4biz.com/How-We-Can-Help/Finance-Programs/

https://www.sba.gov/loanprograms

Grants

https://www.sba.gov/content/research-grants-small-businesses

https://www.sba.gov/content/venture-capital

http://www.grants.gov/ use the keywords “small business”

Oregon Community Offerings

The SBA does not loan money. A SBA loan is a loan made by a traditional lender which is “backed” or guaranteed by the SBA. This means that if you default on your loan, the SBA guarantees to pay your lender a certain percentage of the loan amount.

Small Business Development Centers (SBDCs) also do not loan or grant money.

Economic Development Council of Tillamook County (EDCTC)

Address: 4506 Third St. Suite 101 Tillamook, OR 97141

TIN #93-1205036

Terre Cooper, MBA - Director

Phone: 503-842-8222 ext. 2500